As internal auditing evolves to meet the demands of modern businesses, the Certified Anti-Money Laundering Specialist (CAMS) audit has emerged as a crucial methodology. This blog will introduce the CAMS audit, its relevance in internal auditing, and how it compares to traditional auditing methods [1] .

What is CAMS Audit?

CAMS audit is a comprehensive evaluation of an organization’s conduct, accountability, and management practices, particularly in relation to anti-money laundering (AML) and combating the financing of terrorism (CFT). It assesses whether an organization has effective controls to prevent, detect, and report suspicious transactions. The importance of audits has surged due to stringent AML and CFT regulations, which impose severe penalties for non-compliance. A well-executed audit can help organizations identify areas for improvement in their AML/CFT programs, thereby reducing the risk of reputational damage and financial losses.

What is Traditional Auditing?

Traditional auditing refers to a systematic approach that involves examining financial records and documentation to ensure accuracy and compliance with established standards. This method remains a cornerstone of internal audit practices worldwide. The primary objective of traditional auditing is to provide an independent assessment of an organization’s internal controls and risk management processes.

Characteristics of Traditional Audits

- Risk-based approach: Focus on high-risk areas and processes.

- Objective evaluation: Unbiased assessment of internal controls.

- Systematic examination: Structured methodology ensuring thoroughness.

- Documentation: Comprehensive records maintained throughout the audit process.

Methods Used in Traditional Audits

- Sampling: Reviewing a representative subset of transactions.

- Testing: Hands-on tests of internal controls.

- Observations: Monitoring business activities and employee interactions.

- Interviews: Engaging personnel to gather information about internal controls.

What is CAMS Audit?

The audit framework, designed by the Association of Certified Anti-Money Laundering Specialists (ACAMS), provides a structured approach for assessing an organization’s AML risk management processes. It consists of three main components [2]:

- Risk Assessment: Identifying and prioritizing risks associated with money laundering.

- Control Evaluation: Evaluating the effectiveness of internal controls and policies.

- Monitoring and Review: Ensuring ongoing compliance with AML programs.

Key Features and Benefits of CAMS Audit

- Comprehensive approach: Evaluates all aspects of the organization.

- Risk-based focus: Efficient resource allocation to high-risk areas.

- Improved compliance: Regular audits ensure adherence to regulations.

- Enhanced reputation: Demonstrates commitment to AML prevention.

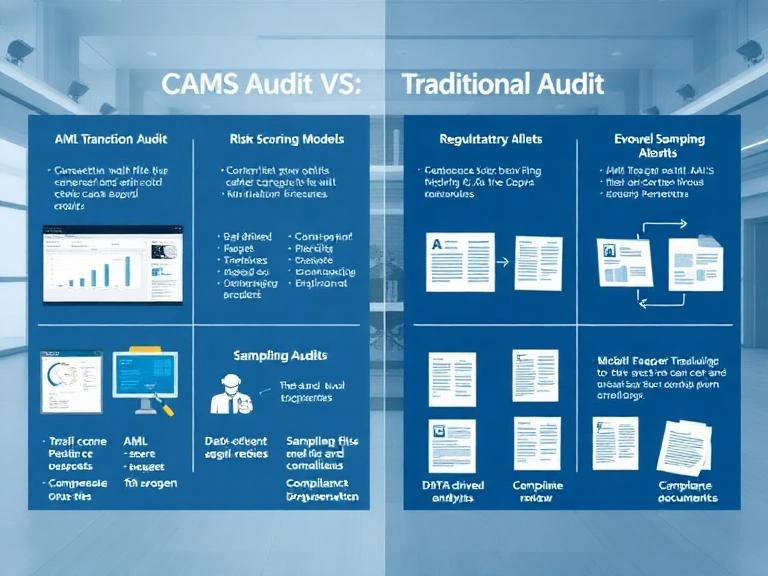

Comparison of CAMS Audit with Traditional Audits

The primary difference between audits and traditional audits lies in their approach. Traditional audits often employ a rule-based methodology, while audits take a risk-based approach, focusing on vulnerabilities in an organization’s AML/CTF framework.

Differences in Scope and Coverage

- Traditional Audits: Typically focus on specific areas like financial reporting.

- CAMS Audits: Examine the entire AML/CTF program, ensuring a holistic understanding of risk exposure.

Technical Requirements

Auditors require specialized knowledge in AML/CTF regulations and the ability to analyze complex data, which is not typically necessary for traditional audits.

Advantages of CAMS Audit over Traditional Audits

Increased Efficiency and Effectiveness

CAMS audit methodology streamlines the audit process, leveraging technology such as data analytics to identify high-risk areas efficiently. This reduces manual effort and increases overall audit effectiveness [3].

Improved Risk Assessment and Mitigation

CAMS audit recognizes that each organization has unique risks, allowing for targeted actions to mitigate AML risks rather than relying on broad measures.

Benefits for Auditors and Organizations

For new auditors, audit offers a structured approach to navigate AML regulations, while organizations can enhance their compliance practices and demonstrate commitment to regulatory standards.

Challenges in Implementing CAMS Audit

While CAMS audit offers numerous benefits, challenges include:

- Resistance to Change: Traditional auditors may resist adopting new methodologies.

- Need for Specialized Training: Organizations must invest in training and resources to ensure effective implementation.

FAQ

What is the primary goal of a CAMS audit?

The primary goal of a CAMS audit is to assess an organization’s AML and CFT practices to ensure compliance with regulations and mitigate risks associated with financial crimes.

How does CAMS audit differ from traditional audits?

CAMS audit focuses on a risk-based approach, examining the entire AML/CTF framework, while traditional audits typically follow a rule-based methodology and focus on specific areas.

Key Takeaways

- CAMS audits are essential for modern internal auditing, particularly in the context of AML and CFT.

- Understanding the differences between CAMS and traditional audits is crucial for new auditors.

- Implementing audit methodologies can enhance organizational compliance and risk management.

Conclusion

In summary, CAMS audit represents a significant evolution in internal auditing, emphasizing a risk-based approach to AML and CFT [4]. As the regulatory landscape becomes more complex, the importance of audits will continue to grow. New auditors and students should recognize CAMS as a vital tool for enhancing their skills and contributing to their organizations’ risk management strategies. By embracing audit methodologies, internal auditors can play a crucial role in preventing financial crime and maintaining organizational integrity.

Find out more about Shaun Stoltz https://www.shaunstoltz.com/about/

This post was written by an AI and reviewed/edited by a human.