Introduction

Maintaining a comprehensive understanding of a project’s portfolio is essential for ensuring successful outcomes. A project portfolio view refers to the aggregated perspective of all projects within an organization, allowing project managers to assess their performance, resource allocation, and alignment with strategic goals. This holistic view enables decision-makers to prioritize initiatives, allocate resources effectively, and identify potential risks across the portfolio.

The significance of Key Performance Indicators (KPIs) in project management cannot be overstated. KPIs serve as quantifiable metrics that provide insights into various aspects of project performance, including time, cost, quality, and stakeholder satisfaction. By establishing clear KPIs, project managers can monitor progress, evaluate success, and make informed decisions that drive project success. These indicators not only help in tracking individual project performance but also play a crucial role in assessing the overall health of the project portfolio.

The connection between KPIs and portfolio health is vital for effective project management. By regularly monitoring KPIs, project managers can identify trends, uncover issues, and make proactive adjustments to ensure that the portfolio remains aligned with organizational objectives. A well-defined set of KPIs allows for early detection of potential problems, enabling teams to address them before they escalate. Ultimately, effective portfolio view monitoring through KPIs empowers project managers and performance analysts to enhance decision-making, optimize resource utilization, and achieve strategic goals.

Understanding Portfolio Performance

In project management, portfolio performance refers to the overall effectiveness and efficiency of a collection of projects and programs within an organization. It encompasses the assessment of how well these projects align with strategic objectives, deliver value, and utilize resources. A well-performing portfolio not only meets its individual project goals but also contributes to the broader organizational mission, ensuring that resources are allocated to initiatives that drive the most significant impact.

Key Factors Contributing to a Healthy Project Portfolio

- Strategic Alignment: One of the most critical factors in portfolio performance is the alignment of projects with the organization’s strategic goals. Projects should be selected and prioritized based on how well they support the overarching objectives of the organization. This alignment ensures that resources are directed toward initiatives that will yield the highest return on investment and drive the organization forward.

- Resource Management: Effective management of resources—such as time, budget, and personnel—is essential for maintaining a healthy project portfolio. This includes ensuring that projects are adequately staffed and funded, as well as monitoring resource allocation to prevent overallocation or bottlenecks that could hinder project progress.

- Risk Management: Identifying and managing risks across the portfolio is vital for maintaining performance. A healthy portfolio includes a proactive approach to risk assessment, allowing project managers to mitigate potential issues before they escalate. This involves regular reviews and adjustments to project plans based on risk evaluations.

- Performance Metrics: Establishing and tracking key performance indicators (KPIs) is crucial for monitoring the health of the project portfolio. KPIs provide quantifiable measures that help project managers assess progress, identify areas for improvement, and make informed decisions. Common KPIs include project completion rates, budget variance, and stakeholder satisfaction.

- Stakeholder Engagement: Engaging stakeholders throughout the project lifecycle is essential for ensuring that projects meet their intended goals. Regular communication and feedback loops help to align expectations and foster collaboration, which can enhance project outcomes and overall portfolio performance.

Alignment with Organizational Goals

The concept of alignment with organizational goals is foundational to effective portfolio management. When projects are aligned with the strategic vision of the organization, they are more likely to receive the necessary support and resources, leading to successful outcomes. This alignment can be achieved through:

- Clear Communication of Goals: Ensuring that all team members and stakeholders understand the organization’s strategic objectives helps to create a unified direction for project efforts.

- Prioritization Frameworks: Implementing frameworks that prioritize projects based on their alignment with strategic goals can help organizations focus on initiatives that offer the most significant benefits.

- Regular Review and Adjustment: Continuously reviewing the portfolio against organizational goals allows for adjustments in project prioritization and resource allocation, ensuring that the portfolio remains relevant and effective in achieving desired outcomes.

Identifying Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) serve as vital metrics that help project managers and performance analysts gauge the health and success of their project portfolios. These indicators provide quantifiable measures that can inform decision-making, optimize resource allocation, and enhance overall project performance. Understanding and tracking the right KPIs is essential for ensuring that a project portfolio aligns with strategic objectives and delivers value to stakeholders.

Crucial KPIs for Monitoring Project Portfolio Health

Return on Investment (ROI)

- Definition: ROI measures the profitability of an investment relative to its cost. It is calculated by dividing the net profit from the project by the total investment cost and is usually expressed as a percentage.

- Impact on Decision-Making: A high ROI indicates that a project is generating significant returns compared to its costs, making it a strong candidate for continued investment. Conversely, a low ROI may prompt project managers to reassess the project’s viability or consider reallocating resources to more profitable initiatives. Tracking ROI helps ensure that the portfolio remains focused on high-value projects.

Net Present Value (NPV)

- Definition: NPV represents the difference between the present value of cash inflows and outflows over a project’s lifespan. It accounts for the time value of money, providing a more accurate picture of a project’s profitability.

- Impact on Decision-Making: A positive NPV indicates that a project is expected to generate more value than it costs, making it a favorable option for inclusion in the portfolio. Negative NPV projects may need to be reevaluated or discontinued. By monitoring NPV, project managers can prioritize projects that contribute positively to the overall portfolio value.

Schedule Variance (SV)

- Definition: Schedule Variance measures the difference between the planned progress of a project and its actual progress at a specific point in time. It is calculated by subtracting the planned value (PV) from the earned value (EV).

- Impact on Decision-Making: A positive SV indicates that a project is ahead of schedule, while a negative SV suggests delays. Monitoring schedule variance allows project managers to identify potential bottlenecks early and take corrective actions to keep projects on track. This KPI is crucial for maintaining the overall timeline of the project portfolio and ensuring timely delivery of outcomes.

KPIs for Financial Health

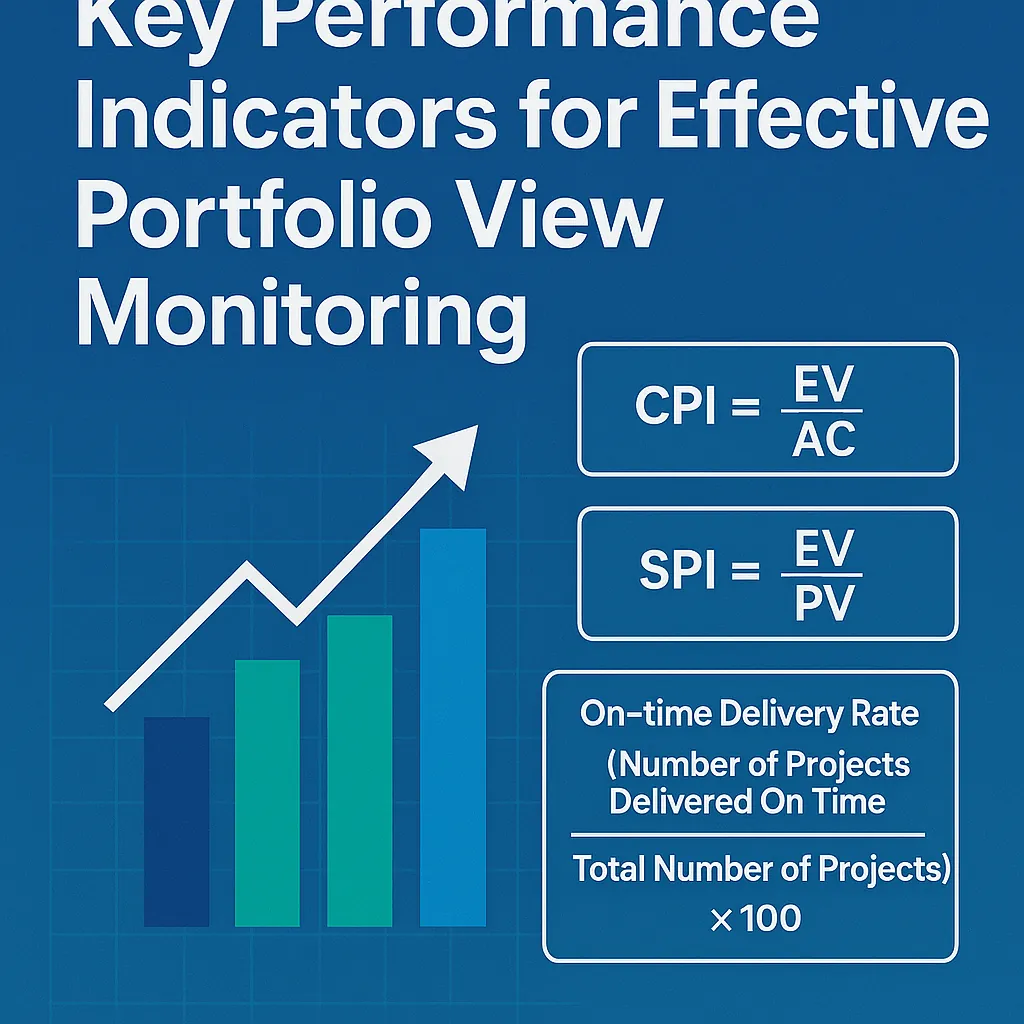

Maintaining a robust portfolio view is essential for ensuring that all projects align with organizational goals and deliver value. A critical aspect of this is monitoring financial health through key performance indicators (KPIs). Here, we will explore crucial financial KPIs, such as the Cost Performance Index (CPI) and Budget Variance, and how they can influence resource allocation and project prioritization.

Key Financial KPIs

Cost Performance Index (CPI):

- Definition: The Cost Performance Index is a measure of cost efficiency and financial effectiveness. It is calculated by dividing the earned value (EV) of a project by the actual cost (AC). The formula is:

CPI = EV / AC - Interpretation: A CPI greater than 1 indicates that a project is under budget, while a CPI less than 1 suggests overspending. For example, if a project has an EV of $100,000 and an AC of $80,000, the CPI would be 1.25, indicating efficient spending.

Budget Variance (BV):

- Definition: Budget Variance measures the difference between the budgeted cost of work performed (BCWP) and the actual cost of work performed (ACWP). It is calculated as:

BV = BCWP – ACWP - Interpretation: A positive BV indicates that the project is under budget, while a negative BV shows that it is over budget. For instance, if the BCWP is $150,000 and the ACWP is $170,000, the BV would be -$20,000, signaling a need for corrective action.

Impact on Resource Allocation and Project Prioritization

Monitoring these financial KPIs is vital for effective resource allocation and project prioritization. Here’s how they influence decision-making:

- Resource Allocation: Projects with a high CPI and positive BV are often prioritized for resource allocation, as they demonstrate financial efficiency. Conversely, projects with low CPI and negative BV may require re-evaluation or additional resources to bring them back on track. For example, if two projects are competing for limited resources, the one with a higher CPI may be favored, ensuring that funds are directed towards the most efficient use of capital.

- Project Prioritization: Financial KPIs can also guide project prioritization. Projects that consistently show strong financial health can be fast-tracked, while those that are struggling may be deprioritized or even halted. For instance, if a portfolio contains several projects, and one project has a CPI of 0.8 while another has a CPI of 1.5, the latter may be prioritized for further investment and support.

Real-World Scenarios

To illustrate the importance of these KPIs, consider the following examples:

- Example 1: A technology company is developing two software applications. Application A has a CPI of 1.2 and a positive BV of $10,000, while Application B has a CPI of 0.9 and a negative BV of -$15,000. The project management team decides to allocate more resources to Application A, as it is performing well financially, while they reassess the strategy for Application B to address its budget issues.

- Example 2: In a construction firm, a project manager tracks the CPI and BV of multiple ongoing projects. One project shows a CPI of 1.1 and a BV of $5,000, indicating it is under budget and on track. Another project, however, has a CPI of 0.7 and a BV of -$25,000. The firm decides to reallocate resources from the underperforming project to the one that is financially healthy, ensuring that overall portfolio performance remains strong.

KPIs for Time Management

Maintaining an effective portfolio view is crucial for ensuring that projects are not only completed but also delivered on time and within budget. Key Performance Indicators (KPIs) play a vital role in monitoring the health of your project portfolio, particularly in the area of time management. This section will delve into essential time-related KPIs, their implications for overall portfolio performance, and strategies for enhancing time management based on KPI insights.

Key Performance Indicators

Schedule Performance Index (SPI):

- The Schedule Performance Index is a critical KPI that measures the efficiency of time utilization in a project. It is calculated by dividing the Earned Value (EV) by the Planned Value (PV):

SPI = EV / PV - An SPI value greater than 1 indicates that a project is ahead of schedule, while a value less than 1 suggests delays. Monitoring SPI across your project portfolio can help identify which projects are on track and which require immediate attention to avoid cascading delays.

On-time Delivery Rate:

- This KPI tracks the percentage of projects delivered on or before their scheduled completion dates. It is calculated as:

On-time Delivery Rate = (Number of Projects Delivered On Time / Total Number of Projects) × 100 - A high on-time delivery rate reflects effective time management practices and can enhance stakeholder satisfaction, while a low rate may indicate systemic issues in project planning or execution.

Implications of Time-related KPIs

Time-related KPIs such as SPI and on-time delivery rate have significant implications for overall portfolio performance:

- Resource Allocation: Understanding which projects are consistently on schedule allows project managers to allocate resources more effectively. Projects that are lagging may require additional support or a reevaluation of their timelines.

- Risk Management: By tracking these KPIs, project managers can identify potential risks early. For instance, a declining SPI may signal that a project is at risk of falling behind, prompting proactive measures to mitigate delays.

- Strategic Decision Making: Time-related KPIs provide valuable insights that inform strategic decisions. For example, if certain types of projects consistently underperform in terms of delivery timelines, it may be necessary to reassess the project selection criteria or the methodologies employed.

Strategies for Improving Time Management

To enhance time management based on KPI insights, consider the following strategies:

- Regular KPI Review: Establish a routine for reviewing time-related KPIs across the portfolio. This should include not only the calculation of SPI and on-time delivery rates but also trend analysis to identify patterns over time.

- Implement Agile Methodologies: Adopting agile project management practices can improve flexibility and responsiveness, leading to better time management. Agile methodologies emphasize iterative progress and regular reassessment of project timelines.

- Training and Development: Invest in training for project teams on time management best practices. This can include workshops on effective scheduling techniques, prioritization, and the use of project management tools that facilitate better time tracking.

- Utilize Project Management Software: Leverage technology to automate the tracking of time-related KPIs. Many project management tools offer built-in reporting features that can provide real-time insights into project schedules and performance.

By focusing on these KPIs and implementing effective strategies, project managers and performance analysts can significantly enhance the scheduling and delivery efficiency of their project portfolios, ultimately leading to improved outcomes and stakeholder satisfaction.

KPIs for Quality and Customer Satisfaction

Maintaining a robust portfolio view is essential for ensuring that projects align with organizational goals and deliver value to stakeholders. A critical aspect of this is the identification and monitoring of Key Performance Indicators (KPIs) that reflect the quality of projects and the satisfaction of customers. Here, we will explore crucial KPIs such as the Customer Satisfaction Score (CSAT) and defect rates, emphasizing their importance in sustaining stakeholder confidence and driving portfolio improvement.

Key Performance Indicators

Customer Satisfaction Score (CSAT):

- Definition: CSAT is a direct measure of customer satisfaction, typically gathered through surveys that ask customers to rate their satisfaction with a product or service on a scale (e.g., 1 to 5).

- Importance: High CSAT scores indicate that projects are meeting or exceeding customer expectations, which is vital for stakeholder confidence. A consistent tracking of CSAT can help project managers identify trends in customer satisfaction over time, allowing for timely interventions when scores dip.

Defect Rates:

- Definition: This KPI measures the number of defects or issues reported in a project relative to the total output or deliverables. It is often expressed as a percentage.

- Importance: Monitoring defect rates is crucial for assessing the quality of project outputs. A high defect rate can signal underlying issues in project execution or quality assurance processes, which can erode stakeholder trust. By keeping defect rates low, project managers can demonstrate a commitment to quality, thereby enhancing stakeholder confidence.

Importance of Quality Metrics

Quality metrics, such as CSAT and defect rates, play a pivotal role in project portfolio management for several reasons:

- Stakeholder Confidence: Consistent quality metrics help build and maintain trust with stakeholders. When stakeholders see that projects are consistently delivering high-quality results, their confidence in the project management team and the organization as a whole increases.

- Informed Decision-Making: Quality metrics provide valuable insights that can inform decision-making processes. By analyzing these KPIs, project managers can identify areas for improvement, allocate resources more effectively, and prioritize projects that align with quality standards.

- Continuous Improvement: Tracking quality metrics fosters a culture of continuous improvement within the organization. By regularly reviewing CSAT and defect rates, project teams can implement changes that enhance project quality and customer satisfaction over time.

Leveraging Feedback for Portfolio Improvement

To effectively utilize feedback for portfolio improvement, project managers can adopt the following strategies:

- Regular Surveys and Feedback Loops: Implementing regular customer surveys can provide ongoing insights into customer satisfaction. This feedback should be systematically analyzed to identify patterns and areas for improvement.

- Root Cause Analysis: When defect rates are higher than acceptable levels, conducting a root cause analysis can help identify the underlying issues. This process not only addresses current problems but also helps prevent future occurrences.

- Stakeholder Engagement: Actively engaging stakeholders in discussions about quality and satisfaction can yield valuable insights. This engagement can take the form of focus groups, interviews, or feedback sessions, allowing stakeholders to voice their concerns and suggestions.

By focusing on these KPIs and leveraging feedback effectively, project managers can enhance the quality of their project portfolios and ensure that they meet the expectations of stakeholders. This proactive approach not only improves project outcomes but also strengthens the overall health of the project portfolio.

Integrating KPIs into Portfolio Monitoring

Maintaining a comprehensive portfolio view is essential for ensuring that all projects align with organizational goals and deliver value. Key Performance Indicators (KPIs) play a pivotal role in this process, providing measurable values that help project managers and performance analysts assess the health of their project portfolios. Here’s how to effectively incorporate KPIs into your monitoring practices.

Tools and Software for KPI Tracking

Utilizing the right tools and software can significantly enhance your ability to track KPIs effectively. Here are some popular options:

- Project Management Software: Tools like Microsoft Project, Asana, and Trello offer built-in features for tracking project progress and performance metrics. They allow for real-time updates and visual dashboards that can display KPIs at a glance.

- Business Intelligence Tools: Platforms such as Tableau and Power BI enable deeper analysis of project data. They can aggregate information from various sources, providing comprehensive insights into portfolio performance.

- Custom Dashboards: Creating custom dashboards using tools like Google Data Studio or Klipfolio can help project managers visualize KPIs tailored to their specific needs, making it easier to monitor trends and make informed decisions.

Best Practices for Reviewing and Analyzing KPIs

Regularly reviewing and analyzing KPIs is crucial for maintaining an effective portfolio view. Here are some best practices to consider:

- Establish a Review Schedule: Set a consistent schedule for KPI reviews, whether it’s weekly, monthly, or quarterly. This ensures that performance is monitored regularly and allows for timely adjustments.

- Involve Stakeholders: Engage key stakeholders in the review process. Their insights can provide valuable context to the data and help identify areas for improvement.

- Use Comparative Analysis: Compare current KPI performance against historical data or industry benchmarks. This can highlight trends and areas where projects may be underperforming.

- Document Insights and Actions: Keep a record of insights gained from KPI analysis and the actions taken as a result. This documentation can serve as a reference for future reviews and decision-making.

Adapting KPIs Based on Project Evolution

As projects evolve, so too should the KPIs used to measure their success. Here’s why adaptability is key:

- Dynamic Project Environments: Projects often face changes in scope, resources, and timelines. Adapting KPIs to reflect these changes ensures that they remain relevant and useful for monitoring performance.

- Feedback Loops: Establish feedback mechanisms that allow for the continuous reassessment of KPIs. This can involve soliciting input from team members and stakeholders to ensure that the KPIs align with current project objectives.

- Focus on Outcomes: Shift the focus of KPIs from outputs (e.g., tasks completed) to outcomes (e.g., value delivered). This change can help project managers better understand the impact of their projects on organizational goals.

Incorporating KPIs into your portfolio monitoring practices is not just about tracking numbers; it’s about creating a framework for informed decision-making and continuous improvement. By leveraging the right tools, adhering to best practices, and remaining adaptable, project managers can ensure that their project portfolios are not only healthy but also aligned with strategic objectives.

Conclusion

Maintaining a robust portfolio view is essential for ensuring the health and success of multiple projects. Key Performance Indicators (KPIs) play a pivotal role in this process, providing project managers and performance analysts with the necessary metrics to assess and enhance portfolio performance. Here are the key takeaways regarding the importance of KPIs in monitoring project portfolio health:

- Importance of KPIs: KPIs serve as vital signposts that help project managers gauge the effectiveness and efficiency of their project portfolios. By tracking these indicators, managers can identify potential issues early, allocate resources more effectively, and make informed decisions that align with organizational goals. This proactive approach not only mitigates risks but also enhances the likelihood of project success.

- Identifying and Tracking KPIs: It is crucial for project managers to take the initiative in identifying and tracking KPIs that are relevant to their specific portfolios. This involves understanding the unique objectives of each project and selecting metrics that reflect their performance. Common KPIs include project completion rates, budget variance, resource utilization, and stakeholder satisfaction. By regularly monitoring these indicators, managers can gain insights into the overall health of their portfolio and make necessary adjustments.

In summary, the effective monitoring of project portfolio health through KPIs is not just a best practice; it is a necessity for achieving strategic objectives. By actively identifying, tracking, and discussing these indicators, project managers can enhance their decision-making processes and drive their projects toward success.

Find out more about Shaun Stoltz https://www.shaunstoltz.com/about/.

This post was written by an AI and reviewed/edited by a human.